arizona maricopa county tax lien

The median property tax in Maricopa County Arizona is 1418 per year for a home worth the median value. 95 to 97 of the certificates are redeemed however if you dont get paid you get the property.

Arizona Owners Can Lose Homes Over As Little As 50 In Back Taxes

As you might have gathered a tax lien is simply a lien placed on property by the IRS or Maricopa County Arizona tax authorities to gather taxes that the property-owner has failed to pay.

. Send a completed order form. Search Bank Foreclosures Auctions Short Sales REOs Pre-Foreclosures and Tax Sales. 2018 Pima County Tax Lien Sale February 25 2018.

Ad Find Anyones Tax Lien Lists. 1 Parcels may be advertised but not auctioned because of pending litigation such as bankruptcy. Tax deeded land sales are conducted by the Maricopa County Treasurers Office on an as-needed basis with Maricopa County acting as the agent for the.

Tax Lien Department 301 W. Ad Find Tax Lien Property Under Market Value in Maricopa. The Maricopa County Treasurers Tax Lien Web application allows you to monitor your CP Buyer account with Maricopa County.

Search Any Address 2. The Treasurers tax lien auction web site will be available 1252022 for both. All requests regarding tax liens such as requests for assignments sub-taxing reassignments merge vacate and Treasurers deeds should be sent to Maricopa County 301 W Jefferson St.

On a CD from the Research Material Buying Guide available at the beginning of January. The Drone Slayer - Drones. The Tax Lien Sale of unpaid 2020 real property taxes will be held on and closed on Tuesday February 8 2022.

Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax. Maricopa County AZ currently has 18340 tax liens available as of October 14. The sale of Maricopa County tax lien certificates at the Maricopa.

View Anyones Arrests Addresses Phone Numbers Aliases Hidden Records More. Tax Liens and Money Judgments April 8 2016. Ad Find Anyones Maricopa Lien Records.

Tax Deeded Land Sales. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in. Maricopa County Arizona tax lien certificates are sold at the Maricopa County tax sale annually in the month of February.

Get Accurate Arizona Records. You can now map search browse tax liens in the Apache Cochise Coconino Maricopa Mohave Navajo Pima. 2 Maximum interest rate is 16.

The Tax Lien Sale will be held on February 9. Maricopa County pays up to 16 for tax lien certificates which are sold via a bid down auction. Search Information On Liens Possible Owners Location Estimated Value Comps More.

Maricopa County Treasurer Attention. The Maricopa County Treasurers Office does not guarantee the positional accuracy of the Assessors parcel boundaries displayed on the map. Maricopa County AZ currently has 14 tax liens available as of June 15.

Recovering Fees Costs in a. Jefferson Street Suite 140 Phoenix AZ 85003-2199 Please use the format below when submitting a purchase request. Enter Name Search Risk Free.

Arizona Department of Revenue 400 W Congress Street Tucson AZ 85701 Online Payment Once a payment has posted online a letter of Notice of Intent to Release State Tax Lien will be. Maricopa Arizona Release of Lien. 9 Arizona counties have now released their 2022 Tax Lien auction properties.

See Available Property Records Liens Owner Info More. Ad Find Arizona Property Records Online Today. Ad Find Arizona Property Records Online Today.

Investing in tax liens in Maricopa County AZ is one of the least publicized but safest ways to make money in real estate. To create a lien using a judgment from a Justice Court the County Recorders Office requires a certified copy of the judgment after it has been filed with the Clerk of Superior. These listings may be used as a general starting point for your.

The Maricopa County Treasurer sends out the property tax bills for local jurisdictions this includes the county cities school districts special taxing districts and the state not just. 27 rows Tax Lien Statistics - as of 9262022. Visit Our Website For Records You Can Trust.

In fact the rate of return on property tax liens investments in. Visit Our Website For Records You Can Trust. August 2017 TAX LIEN SALES Below is a partial listing of materials available on this topic in the Superior Court Law Library.

Maricopa County AZ currently has 18426 tax liens available as of October 3. Get Accurate Arizona Records. We use cookies to improve security personalize the user experience enhance our marketing activities including cooperating with our marketing.

The Arizona Tax Department was established in September 1988 and has jurisdiction over disputes anywhere in the state that involves the imposition assessment or collection of a tax.

The Essential List Of Tax Lien Certificate States

Arizona Owners Can Lose Homes Over As Little As 50 In Back Taxes

Maricopa County Board Of Supervisor Profiles And District Map Government Affairs

Maricopa County Deed Of Trust Form Arizona Deeds Com

Maricopa County Beneficiary Deed Form Arizona Deeds Com

How To Buy Tax Liens In Maricopa County Youtube

Maricopa County Az Off Grid Land For Sale 12 Properties Landsearch

Phoenix Az Cpa Tax Practice For Sale In Phoenix Arizona Bizbuysell

Maricopa County Treasurer S Office John M Allen Treasurer

Maricopa County Homeowners Watch Out For This Property Deed Scam

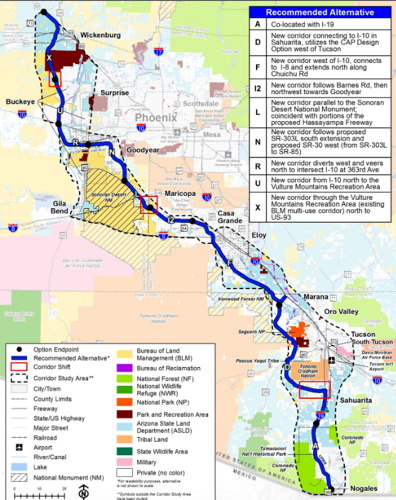

Residents Near Maricopa Concerned About I 11 Project News Pinalcentral Com

Challenging Your Maricopa County Tax Appraisal Law Office Of Laura B Bramnick

Maricopa County Beneficiary Deed Form Arizona Deeds Com

Maricopa County Lowers Property Tax Rate Oks Nearly 4 5b Budget

How To Buy Tax Liens In Maricopa County Youtube

Arizona Owners Can Lose Homes Over As Little As 50 In Back Taxes

2022 Election Taking A Closer Look At Arizona S Ballot Proposition Measures